2025 Synthetic Fragrance Market — Comprehensive Trend Analysis

Introduction

Synthetic fragrances remain the backbone of modern perfumery, personal care and home-care formulations because they deliver consistency, cost-efficiency and design freedom that natural extracts alone cannot provide. This article analyzes the 2025 market landscape for synthetic fragrances — size and regional dynamics, drivers and risks, competitive moves, and concrete strategic recommendations for suppliers and brand owners.

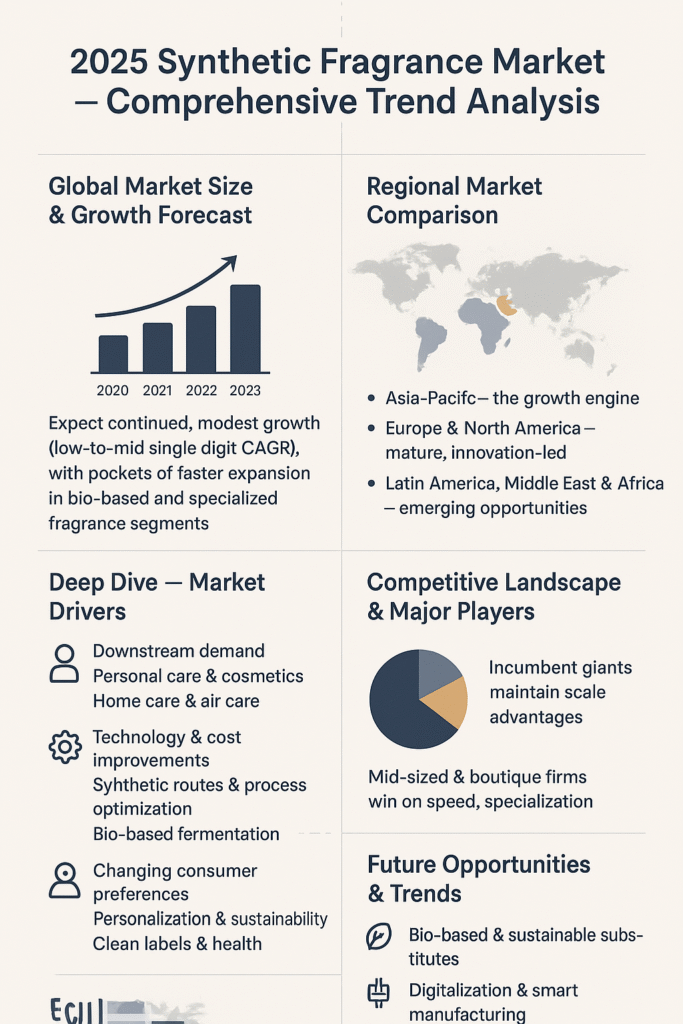

Global Market Size & Growth Forecast

Multiple market reports place the broader fragrance and flavors-and-fragrances complex on steady growth through the mid-2020s. One leading estimate values the global fragrance market in the mid-$50 billions and projects steady expansion driven by premiumization and new downstream applications. (Grand View Research) Another industry forecast for the combined flavors & fragrances sector indicates a mid-single digit CAGR in the immediate 2025 horizon, reflecting both food/beverage and home & personal care demand. (商业研究公司)

Key takeaway: expect continued, modest growth (low-to-mid single digit CAGR), with pockets of faster expansion in bio-based and specialized fragrance segments.

Regional Market Comparison

Asia-Pacific — the growth engine

APAC continues to outpace mature markets due to rising disposable incomes, rapid expansion of beauty & personal care, and local brands scaling quickly across e-commerce and modern retail. Investment in local production and regional formulation labs supports faster time-to-market for tailored scents.

Europe & North America — mature, innovation-led

These markets emphasize regulation, sustainability and premiumization. R&D and brand storytelling (clean labels, provenance) drive value rather than volume.

Latin America, Middle East & Africa — emerging opportunities

Growing urbanization, expanding retail distribution and localized fragrance preferences create attractive niches, particularly for affordable personal care and household fragrance formats.

(Regional patterns above align with general market-growth breakdowns from industry reports.) (商业研究公司)

Deep Dive — Market Drivers

1. Downstream demand

- Personal care & cosmetics: fragrances remain central to product differentiation across moisturizers, deodorants, haircare and prestige perfumes.

- Home care & air-care: growth in liquid detergents, fabric softeners, reed diffusers and scented consumer goods expands volumes for synthetic ingredients due to stability and cost advantages.

These application demands are consistent with the broader flavors & fragrances growth narrative. (商业研究公司)

2. Technology & cost improvements

Advances in synthetic routes, process intensification and catalytic chemistry lower unit costs and expand the palette of available molecules. Parallel improvements in biotechnology (fermentation, precision fermentation) are enabling new ingredient classes that mimic natural molecules at scale and lower environmental footprints. Industry reporting on bio-innovation underscores biotech’s rising role in beauty and ingredient sourcing. (Vogue Business)

3. Changing consumer preferences

Consumers — especially younger cohorts — want personalization, ethical sourcing, and transparency. This fuels demand for both customized synthetic accords (created rapidly and affordably) and bio-based/sustainable alternatives that deliver similar olfactory profiles with lower ecological impact. Market estimates for bio-based fragrance segments show higher growth rates compared to legacy synthetic segments. (Dataintelo)

Competitive Landscape & Major Players

The fragrance sector remains consolidated at the top, with global leaders (creation houses and ingredient manufacturers) commanding meaningful share while nimble specialists and regional houses capture niche opportunities. Strategic M&A and local acquisitions continue to reshape portfolios — notably the creation of DSM-Firmenich through the DSM/Firmenich combination (creating a large innovation-led player) and ongoing acquisitions by other multinationals to strengthen regional presence and capabilities. (DSM Firmenich Investors, 吉伟公司)

What this means: incumbent giants maintain scale advantages (R&D, global distribution), but mid-sized and boutique firms can win on speed, specialization, and local knowledge.

Industry Challenges & Risks

- Raw material volatility & supply chain risk: crop yields, trade policy and logistics can spike costs or limit access to key natural precursors — pushing formulators toward synthetics or biotech alternatives.

- Regulatory pressure & compliance costs: tightening environmental and safety standards increase testing, documentation and reformulation demands — especially in Europe.

- Market access & certification hurdles: green claims, “natural” labeling and certifications carry both opportunity and compliance burdens.

Future Opportunities & Trends

- Bio-based & sustainable substitutes: demand for bio-sourced fragrance molecules (fermentation-derived or biocatalyzed) is accelerating and represents a high-growth subsegment. (Dataintelo)

- Digitalization & smart manufacturing: formulation software, AI-driven scent design and Industry 4.0 production yield faster iteration and cost control.

- Multi-functional scents & wellness integration: fragrances that claim mood, sleep or antimicrobial benefits (paired with substantiated claims) will gain attention.

- Regional product segmentation: targeted accords for local culture/markets will continue to outperform one-size-fits-all global SKUs.

Strategic Recommendations (for suppliers & brands)

- Invest in R&D & biotech partnerships — accelerate access to bio-based molecules and predictive fragrance design tools. (Vogue Business)

- Diversify supply chains — dual sourcing and regional production mitigate price and logistics risk.

- Differentiate via sustainability credentials and storytelling — transparently document lifecycle impacts to capture premium buyers.

- Pursue selective M&A or alliances — acquire regional houses or tech startups to gain local market knowledge and new capabilities. (吉伟公司)

Conclusion

The synthetic fragrance market in 2025 is one of steady baseline growth with higher-velocity pockets in bio-based ingredients, digitalized formulation and regionally tailored solutions. Market leaders will combine scale and innovation; challengers will win through agility and specialization. For participants, the winning playbook is clear: invest in sustainable synthesis (including biotech), diversify supply chains, and use data + storytelling to capture premium positioning.

References & Data Sources

- Grand View Research — Fragrance Market Size And Share | Industry Report, 2030. (Grand View Research)

- The Business Research Company — Flavors And Fragrances Market Report 2025-2034. (商业研究公司)

- DataIntelo — Bio-based Fragrance Market Report. (Dataintelo)

- DSM-Firmenich investor pages — merger & corporate information. (DSM Firmenich Investors)

- Givaudan — acquisitions and regional growth activities (June 2025 example). (吉伟公司)